Reefer service - Market outlook 2024

| Written by Mark Buzinkay

No video selected

Select a video type in the sidebar.

What does the 2024 Reefer service Market have in store?

The global reefer container market is experiencing significant growth, driven by the escalating demand for pharmaceuticals, the expansion of trade routes, the burgeoning e-commerce industry, and advances in real-time tracking technology. In 2023, the market size was recorded at 4,004.7 thousand twenty-foot equivalent units (TEU) and was projected to reach 7,142.8 thousand TEUs by 2030, advancing at a compound annual growth rate (CAGR) of 8.8% during the 2024-2030 period. This article delves into the dynamics of this growth, with a particular focus on the Asia-Pacific (APAC) region, which holds a dominant position in the global market.

The reefer container market is pivotal in the global transportation of temperature-sensitive goods, including perishable foods and pharmaceutical drugs. These containers ensure that fruits, vegetables, seafood, and vaccines retain quality and efficacy during long-haul transportation. The market's expansion is attributed to several factors:

- Pharmaceutical Industry Growth

- Expansion of Trade Routes

- E-Commerce Boom

- Technological Advancements

What are the Growth Drivers for an reefer service?

The global reefer container market's robust growth is propelled by a confluence of factors that address both the supply and demand sides of the market. These drivers underscore the market's current expansion and lay the groundwork for its future trajectory.

Increasing Demand for Perishable Goods

The escalating global demand for perishable goods is a pivotal factor driving the market. Consumers worldwide have developed a preference for fresh fruits, vegetables, seafood, and other perishable items, necessitating reliable temperature-controlled logistics solutions. The reefer container market is at the forefront of meeting this demand, ensuring that perishables are transported optimally, thus maintaining quality and extending shelf life.

Pharmaceutical Industry Expansion

The pharmaceutical industry's rapid growth has profoundly impacted the reefer container market. With the global population ageing and becoming more health-conscious, there is an increased demand for pharmaceutical drugs, many of which are temperature-sensitive. The transportation of vaccines, biologics, and other healthcare products requires precise temperature control to preserve their efficacy, driving the need for advanced reefer solutions.

E-Commerce and Online Grocery Sales Surge

The surge in e-commerce and online grocery sales further accelerates the demand for reefer containers. As consumers increasingly turn to online platforms for shopping, the reefer logistics sector must adapt to deliver perishable goods efficiently. The convenience and speed expected by online shoppers necessitate reefer containers to maintain product quality from warehouse to doorstep, particularly in developing countries with rapidly growing digital marketplaces.

Technological Advancements

Technological advancements in reefer container technology are crucial in driving market growth. Innovations such as dual-temperature refrigerated containers with controlled atmosphere functions cater to shippers' diverse needs, enabling the transportation of a wider variety of goods. Additionally, real-time tracking technology has revolutionized the logistics of temperature-controlled shipping, offering both shippers and consumers transparency and peace of mind (read about Port Hamburg Germany operations as an example).

Expanding Trade Routes

Expanding trade routes is a critical driver for the reefer container market. As global trade networks become more intricate, there is a heightened need for efficient, reliable refrigerated transport solutions to navigate these routes. The growth in trade agreements and opening new markets have facilitated access to a broader range of perishable goods, further stimulating the demand for reefer containers (see also: Caribbean exports).

Regulatory Changes and Sustainability Efforts

Finally, regulatory changes and sustainability efforts impact the reefer market. Governments and international bodies are implementing stricter regulations on food safety and pharmaceutical transport, necessitating advanced reefer containers. Simultaneously, the push towards reducing carbon footprints and enhancing sustainability in logistics has led to innovations in reefer technology that are more energy-efficient and environmentally friendly.

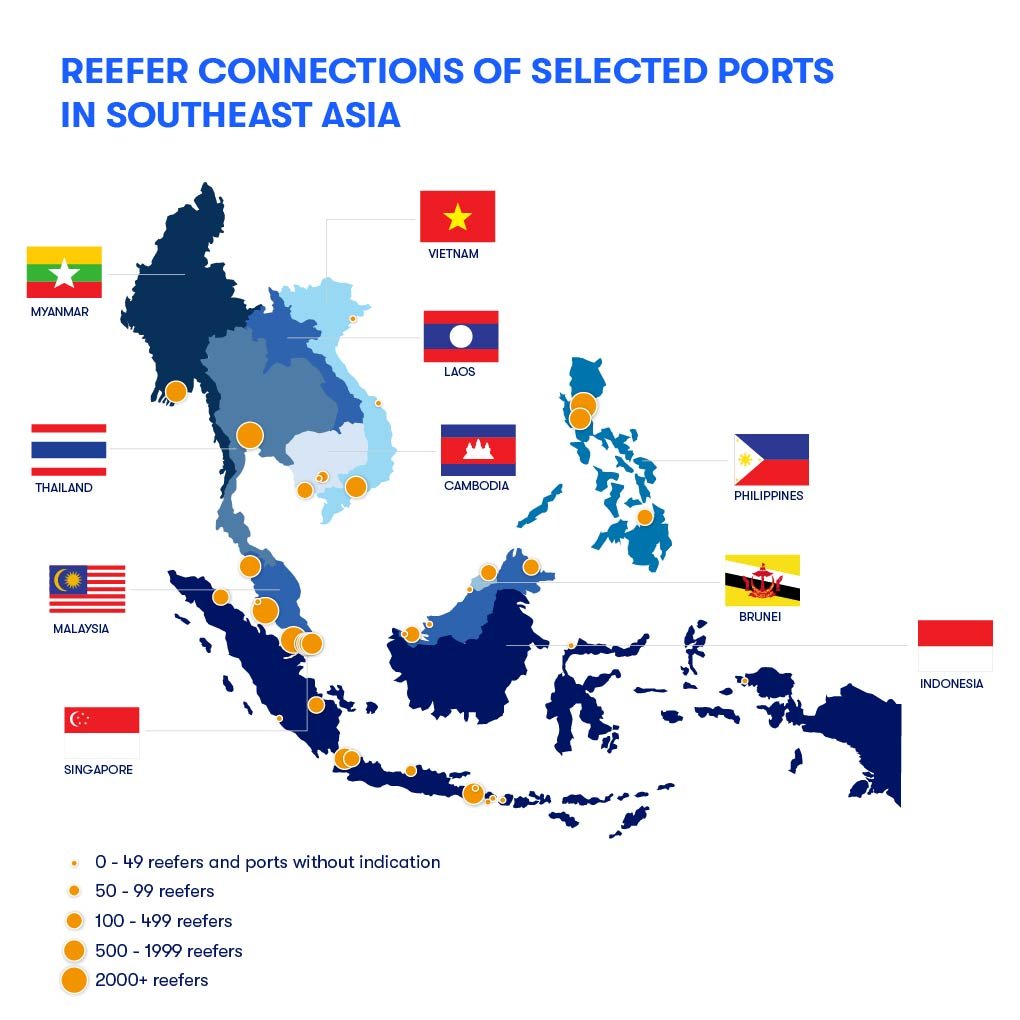

The APAC Market: An In-Depth Look in reefer service

The Asia-Pacific (APAC) region, accounting for 60% of the global reefer container market share in 2023, is a pivotal player in the temperature-controlled logistics landscape. This dominance is attributed to the region's rapid economic growth, expanding trade routes, and significant technological advancements in reefer container technology.

The APAC reefer market has shown remarkable resilience and growth potential, driven by robust economic indicators and an increasing demand for perishable goods. With a population exceeding 4.3 billion, the region's massive consumer base demands a steady supply of fresh and quality perishable products, from food to pharmaceuticals. The region's commitment to enhancing its logistics and transportation infrastructure further bolsters the market's growth, aiming to facilitate smoother and more efficient trade flows.

Key Countries Driving the Market

- China: As the world's largest e-commerce market, China's demand for reefer containers is propelled by its booming online retail sector, requiring efficient cold chain solutions to deliver perishable goods. China's role as a major exporter of electronics, pharmaceuticals, and food products further amplifies its need for advanced reefer containers.

- India: India's rapidly growing economy, coupled with its increasing online shopper base, has led to a surge in demand for reefer containers. The country's vast agricultural sector and the burgeoning pharmaceutical industry contribute significantly to this demand.

- Japan and Australia: Both countries are notable for their high living standards and consumer demand for quality perishable imports, driving the need for sophisticated reefer logistics solutions to connect them with global markets.

Role in Global Reefer Trade Routes

The APAC region is integral to several critical global reefer trade routes, serving as both a significant exporter and importer of perishable goods. Its strategic location along major maritime routes facilitates the efficient movement of reefer cargo to and from Europe, North America, and other parts of the world. Expanding trade agreements and economic partnerships within the region and with other global players has further solidified APAC's position in the reefer market.

Challenges and Opportunities

While the APAC reefer market is poised for growth, it faces challenges, including logistical inefficiencies, varying regulatory standards, and infrastructure constraints. However, these challenges also present opportunities for innovation and development. The push for digitalization and the adoption of IoT in logistics are paving the way for more efficient and transparent reefer operations. Furthermore, investments in infrastructure and regulatory harmonization are expected to mitigate logistical hurdles, enhancing the region's competitiveness.

FAQ: Market 2024 for reefer services

What are the main drivers of growth in the reefer market in 2024?

Several key factors primarily drive the reefer market's growth in 2024. Firstly, the expanding global demand for pharmaceuticals, which require strict temperature-controlled environments during transport, significantly contributes to the market's expansion. Secondly, increasing global trade routes facilitates the demand for reefer containers to transport various perishable goods across longer distances. Additionally, the surge in e-commerce, particularly in developing countries, has elevated the need for efficient cold chain logistics solutions to meet consumer expectations for fresh goods delivery. Lastly, technological advancements, including real-time tracking and dual-temperature refrigerated containers, have enhanced the efficiency and reliability of reefer transport, further propelling market growth.

How will the APAC region influence the global reefer market in 2024?

In 2024, the Asia-Pacific (APAC) region continues to play a pivotal role in the global reefer market, primarily due to its significant market share, which accounted for 60% in 2023. The region's influence is attributed to its rapid economic growth, an increase in online retail, and the rising demand for fresh and quality perishable products. Countries like China and India, with their large consumer bases and booming e-commerce sectors, are major contributors to this demand. Additionally, technological innovations specific to the reefer market, such as advanced tracking systems and dual-temperature containers, are increasingly being adopted in APAC, further solidifying its impact on the global market.

What challenges and opportunities exist for the reefer market in 2024?

The reefer market 2024 faces several challenges, including logistical inefficiencies, regulatory hurdles, and the high costs of maintaining and operating reefer containers. Despite these challenges, there are significant opportunities for growth and development. The ongoing expansion of e-commerce presents a vast potential for the cold chain logistics sector to innovate and improve its services. Additionally, technological advancements, such as IoT-based tracking and monitoring systems, offer opportunities to enhance transparency and efficiency in the reefer logistics chain. Moreover, the increasing focus on sustainability and reducing carbon emissions in the logistics sector may drive the adoption of greener technologies and practices in reefer operations, opening new avenues for market growth.

Takeaway

The reefer market is poised for substantial growth by 2024, fueled by the pharmaceutical boom, expanding global trade, e-commerce proliferation, and technological innovations. With its significant market share, the Asia-Pacific region is a critical driver of this expansion, offering both challenges and opportunities. As the industry navigates logistical and regulatory hurdles, the adoption of advanced technologies and a focus on sustainability are key to future success. This evolving landscape presents a promising outlook for stakeholders, highlighting the importance of adaptability and innovation in capitalizing on the burgeoning demand for temperature-controlled logistics solutions.

Delve deeper into one of our core topics: Refrigerated containers - Monitoring & Management

Glossary

Consumer transparency refers to the practice of openly sharing information with consumers about a company’s operations, products, and policies. It includes clear communication about pricing, sourcing, sustainability efforts, and data usage. By fostering trust and empowering informed decision-making, consumer transparency strengthens brand loyalty and enhances customer satisfaction. It is increasingly vital in today’s digital age, where consumers demand accountability and ethical practices from businesses. (2)

Dual-temperature refrigerated containers are specialized units designed to maintain two distinct temperature zones within a single container, allowing simultaneous transportation of goods with varying temperature requirements, such as frozen and chilled products. These containers feature internal partitions and independent cooling systems for each zone, offering flexibility, cost efficiency, and compliance with industry regulations. They are widely used in industries like food and pharmaceuticals to ensure product integrity during transport. (3)

Sources:

(1) PS Intelligence, Feb 2024

(2) Frances Frei and Anne Morriss (2024): Uncommon Service: How to Win by Putting Customers at the Core of Your Business. Harvard Business Review Press.

(3) Ioannis Manikas (2023): Refrigerated Transportation: Best Practices and Trends. Routledge.

Note: This article was updated on the 12th of March 2025

Author

Mark Buzinkay, Head of Marketing

Mark Buzinkay holds a PhD in Virtual Anthropology, a Master in Business Administration (Telecommunications Mgmt), a Master of Science in Information Management and a Master of Arts in History, Sociology and Philosophy. Mark spent most of his professional career developing and creating business ideas - from a marketing, organisational and process point of view. He is fascinated by the digital transformation of industries, especially manufacturing and logistics. Mark writes mainly about Industry 4.0, maritime logistics, process and change management, innovations onshore and offshore, and the digital transformation in general.